A deposit receipt template is an authoritative record that addresses that a specified sum of amount has been deposited for a purchase or subscribing to some sort of services. A deposit receipt is generally utilized by monetary associations to keep a record of cash for further processing their audit and financial plans. It fills in as an authentic record that verifies some measure of money has been received from a customer by a merchant or some association. The bank or the money related establishment will likewise keep a duplicate of the store receipt. To counteract future misconceptions or question, a deposit receipt must be kept as confirmation or a proof that the specific measure of money has been saved. Deposit receipt template guarantees that the trade saved out a bank or some other budgetary organization has been recorded in the papers.

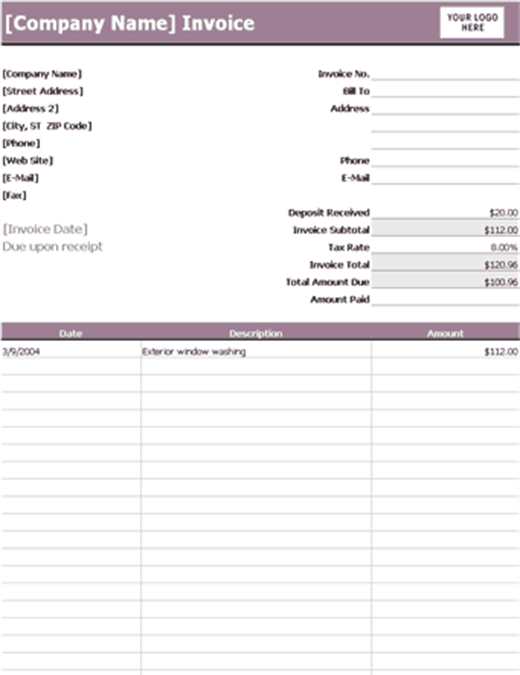

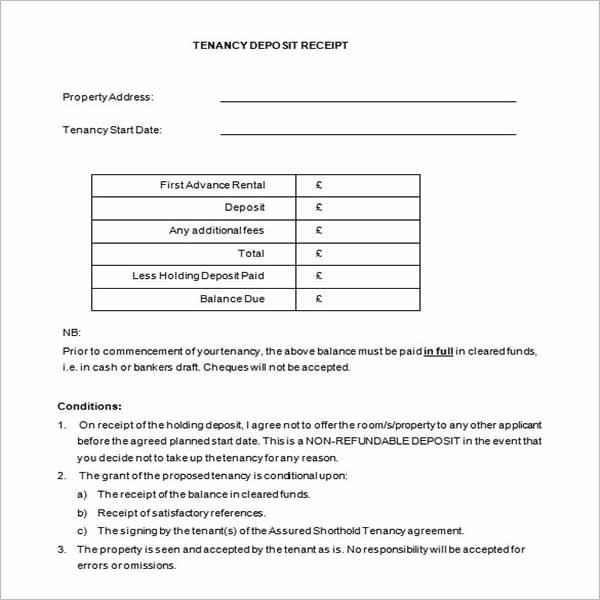

It will often contain the following information: name of title company, address of title company, name of title’s company bank, the title’s company bank account number, the receipt number, the escrow number, the property address, date of deposit, name of person who received the receipt, amount of deposit, name of the payer (which is usually the buyer) and copy of the original check. This format is generally issued after the buyer’s earnest money deposit has been deposited into the title or Escrow Company’s bank account. It proves that the buyer actually handed over the earnest money deposit.

A deposit receipt template can be generated in a number of variant templates but it must have some fundamental components which incorporate the name of the company or the merchandise issuing it along with their logo printed at the top or watermarked in the background. It also contains the time and date at which the deposit was made and the measure of the amount deposited. The name of the individual receiving the deposit may likely be mentioned in the deposit receipt template. The record number of the receipt is imprinted on the top corner of the receipt which is a unique code allotted to every receipt in the booklet. The collector also marks his/her signatures and the contact details of the collector are mentioned alongside the name. The method used for making the deposit is likewise mentioned on the deposit receipt template and a stamp is marked that verifies that the deposit has been made. A store receipt format ends up being useful if some sort of legitimate issue emerges and can be introduced as confirmation in the court.