A budget planner template is a simple process of financial plan by which an individual or company valuate their expenses and earnings as well as creating a plan to spend money. Budgeting is one of the best method by which you easily balance your expenses with your income and if you don’t balance or spend more than your income you will definitely have a problem. An accurate budget ensures that you will always have enough money for the things you need or in case of any emergency. It will keep your finance on track and it puts checks or balances in place so that prevent overspending. Some basic purposes of making an accurate budget planning is gives you control over your money, keep you focused on your money goals, makes you aware what is going on with your money and enables you to produce extra money.

Importance of Budget Planner

You can use a personal budget template to keep your spending habits in check throughout your college years all you have to do is fill out your expenses for each semester. You can make an annual budget plan for your family and keep track of your monthly, quarterly and annual expenses. No matter whether you prefer weekly or monthly budget template, the important thing about budgeting is to start now. This will surely help you in achieving your short and long term financial goals. Getting a handle on where your money goes as soon as possible will give you information that where you need to make necessary changes.

Details of Budget Planner

Generally budgets are designed enough flexible so that you can easily fulfill your needs but if budget is planned too tight it may become an issue. Some basic steps for creating an effective budget plan such as calculate your income, calculate your expenses, set your goals, define your budget into major categories, list your expenses for each category, decide a method to keep track of your budget, set your ledger and decide how long your budget planner template must last.

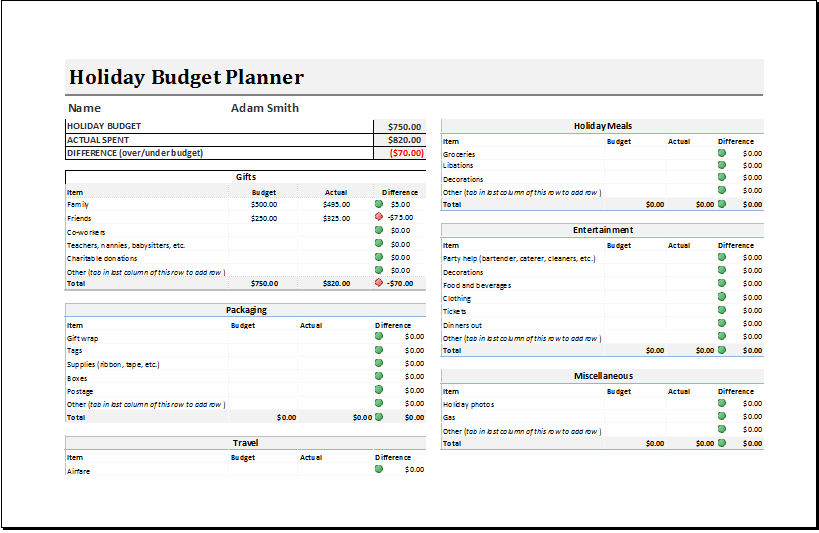

Image of Template